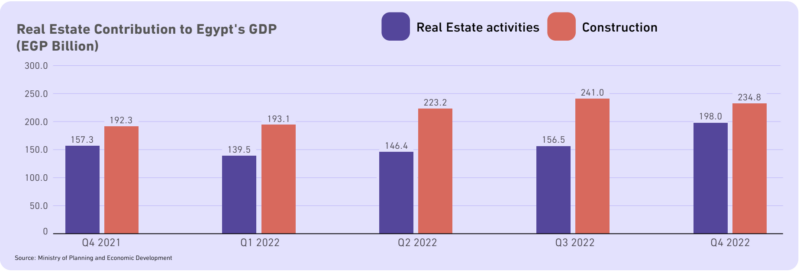

According to the Market Watch report, despite the broader economic challenges like high inflation and exchange rate instability, the real estate sector showed remarkable resilience, marking a growth rate of 22% YoY in Q4 2022.

Whether you’re a home buyer or investor, it’s important to have visibility over the real estate market, which is surely impacted by Egypt’s economic situation.

For more information and detailed insights, keep reading this quick guide, which will give you an overall view of the market and the new projects’ status.

Highlights

- Egypt’s real GDP recorded a 3.9% growth in Q1 2023, mirroring the growth observed in the preceding quarter and the positive effects of sectors such as tourism, agriculture, and construction on Egypt’s GDP

- These findings show the positive momentum and substantial contributions of the construction and real estate activities sectors to Egypt’s economic performance.

Market Prospects

The Market Prospects section will take you through the details of the real estate market in Egypt during Q2 2023. It will give you insightful information about the new projects that contribute to the sector’s growth and bring new opportunities for you, whether you’re a resident or an investor.

- The residential and mixed-use real estate sector achieved a significant number of ongoing projects with a total number of 534 and worth USD 329,575 million.

These projects represented approximately 50% of the total number of projects and 75% of the total investments.

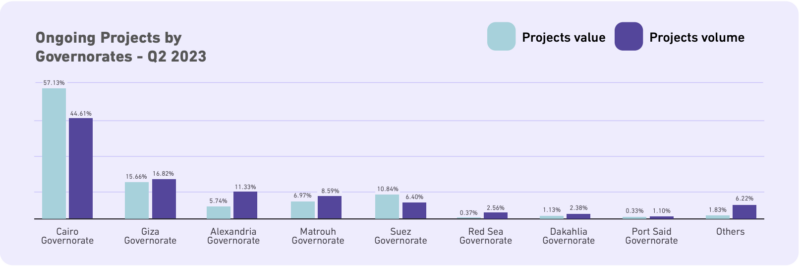

- The governmental development stretches across 13 different governorates, while the private sector’s activity is at 20 governorates.

- Cairo and Giza governorates have the highest contribution of almost 80% of the total investment of the private sector.

- Owing to the industrial and commercial development in the Suzes Canal areas, the Canal Zone contributed to almost 80% of the total governmental investment in governmental development.

Cairo

- The capital is where the majority of residential real estate investments take place, representing approximately 57% of the total investment.

- Additionally, the New Administrative Capital has a share of approximately 44% of the total investments in Cairo. This reflects the great impact of this huge project on the overall market.

Giza

- The residential real estate investments in this governorate reached approximately 16% of the total, across 7 different areas and communities.

Among these areas is October City, which has over 61% of the investments, while Sheikh Zayed City has accounted for 21% of the total investment.

The real estate market in Egypt has promising prospects, with numerous ongoing projects that drive growth. Moreover, the Cairo and Giza governorates are considered the key investment destinations in the country

Ongoing Projects Progress

- The ongoing projects in Egypt span across 21 governorates and reach very promising and advanced stages of development.

- About 54% of these projects have reached halfway their completion, while 13% of them are reaching the completion stage as over 90% of the construction is already finished.

- Another 17% of the projects are now between 75% and less than 90% complete.

Cairo

- The construction process of the projects in Cairo made recognizable progress.

- Around 62% of the projects in the capital are halfway through the construction process,

- 14% are in the final stages of completion

- 28 % of the projects in the range of 50% to 75% completion

- 20% % of projects in the range of 75% to 90% completion.

Launched Projects in Q2 2023

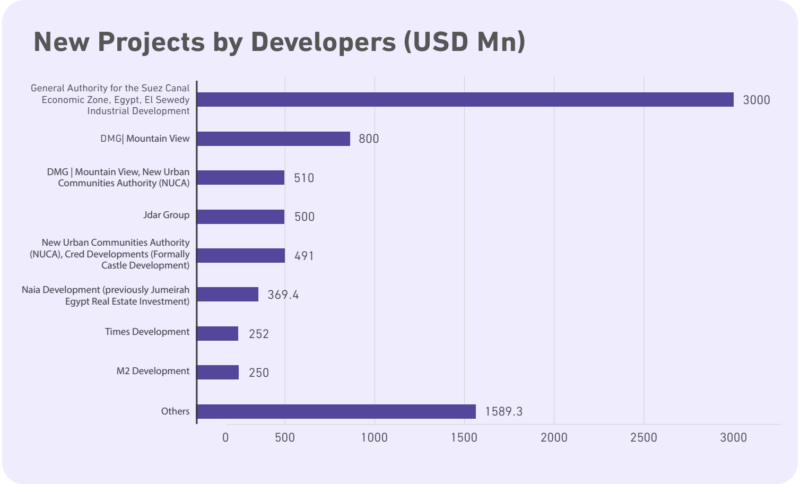

- In comparison to Q2 2022, the number of newly launched real estate projects in Egypt experienced a significant decline of 60%.

This decrease can be due to the rising costs of construction, which has been observed since Q4 2022. However, Q2 2023 witnessed a start of construction for about 34 projects in 8 different governorates.

Their estimated total cost is USD 7.7 billion, compared to only 9 projects in Q1 2023, with a value of 1 billion, showing a significant development.

- During Q2 2023, a total of 32 developers took the initiative to develop new

projects.

- Mountain View (DMG) investment amounts to approximately USD 1.3 billion, which represents about 17% of Q2 2023 total investment.

- In addition, JDAR Group had planned investments of around USD 500 million for one project in North Coast.

Cairo

- The capital had 41% of the total launched projects; New Cairo, specifically, has 2 notable projects, which are Mountain Park and Lagoon Beach Park.

In addition, in Q2 2023, the New Administrative Capital witnessed the start of 4 projects, which are Ri8 Compound, Talah Compound, Oaks Egypt Hotel, and Haven Business Tower.

Giza

- Among the total new projects launched in Q2 2023, Giza Governorate captured 29% of them.

New Zayed City in Giza witnessed 7 projects: Naia West, the Dejoya Compound, the Palm Gate compound, and Alara compound.

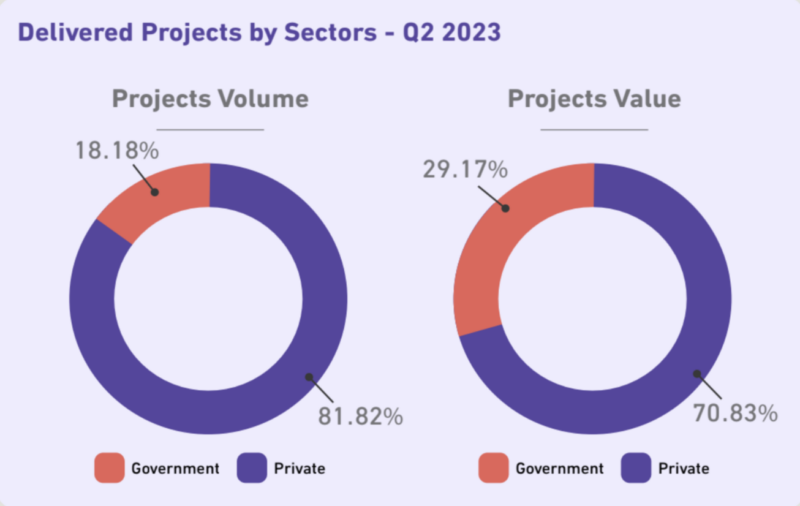

Delivered projects in Q2 2023

- A total of 11 projects were successfully delivered in Egypt during Q2 2023, with a combined value of USD 875 million. This shows a notable increase of

- 19% in terms of the volume of the projects compared to Q2 2022

- 46% in terms of value compared to the same period last year.

- Overall, Q2 2023 witnessed a successful delivery of different real estate projects across Egypt, with Mokttam and 6th of October areas being the key areas of focus.

Cairo

- Approximately 36% of these projects were located in Cairo across 4 different areas, which are Mokattam, Mostakabl City, New Administrative Capital, and New Cairo.

Their value represents 28% of the total investment in Q2 2023

Giza

Giza accounted for 27% of the delivered projects, with a total value of USD 322 million.

The New Administrative Capital (NAC)

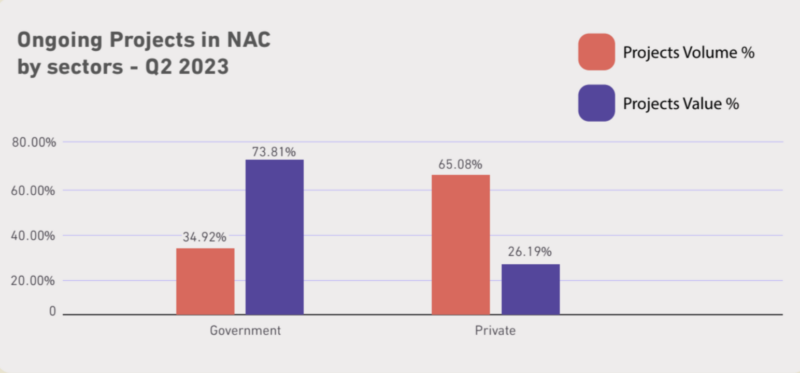

- During Q2 2023, the New Administrative Capital had 25% of the total investments in Egypt, with 97 ongoing projects with a value of $68,528 million.

- For the ongoing projects in Q2 2023, the governmental investment had a share of 74% of the total investment in NAC across 34 projects.

While the private sector had a share of 26% of the total investment in the city with 63 ongoing projects.

- The ongoing projects in the NAC are in different development stages:

- Approximately 67% have crossed the midway point.

- 12% of them are about to be completed, with over 90% of the construction already finished

- 22% of the projects are now between 75% and less than 90% complete.

- During Q2, 2023, the New Administrative Capital witnessed the launch of 4 projects with a value of $399 million, showing a 60% decrease compared to Q1 2023.

Projects Launched in NAC During Q2 2023

- Ri8 Compound by ERG Developments

- Talah compound by New Plan Developments

- Oaks Egypt Hotel by Margin Development

- Haven Business Tower by EGICS

High-in-Demand Areas for Rent and Sale

| Apartments for Sale | Villas for Sale | Apartments for Rent | Villas for Rent |

| New Cairo City | 6th of October City | New Cairo City | 6th of October City |

| 6th of October City | Madinaty | 6th of October City | El Maadi |

| El Maadi | New Cairo City | El Maadi | Madinaty |

| Sheikh Zayed City | Sheikh Zayed City | Madinaty | New Cairo City |

| Nasr City | Shorouk City | Nasr City | Sheikh Zayed City |

Property Sale Prices in Egypt

The table below shows the average asking prices for apartments in Egypt in Q2 2023:

| Three Bedrooms | Two Bedrooms | One Bedroom | Area |

| EGP 3,200,000 | EGP 2,450,000 | EGP 2,100,000 | New Cairo City |

| EGP 2,000,000 | EGP 1,400,000 | EGP 1,050,000 | 6th of October City |

| EGP 2,300,000 | EGP 1,700,000 | EGP 800,000 | El Maadi |

| EGP 3,610,000 | EGP 3,000,000 | EGP 2,400,000 | Sheikh Zayed City |

| EGP 2,000,000 | EGP 1,250,000 | EGP 1,000,000 | Nasr City |

The table below shows the average asking prices for villas in Egypt in Q2 2023:

| Five Bedrooms | Four Bedrooms | Three Bedroom | Area |

| EGP 9,000,000 | EGP 8,000,000 | EGP 6,370,000 | 6 October City |

| EGP 20,000,000 | EGP 13,000,000 | EGP 8,000,000 | Madinaty |

| EGP 15,000,000 | EGP 10,000,000 | EGP 8,000,000 | New Cairo City |

| EGP 10,500,000 | EGP 8,500,000 | EGP 6,700,000 | Sheikh Zayed City |

| EGP 8,500,000 | EGP 6,200,000 | EGP 5,781,000 | Shorouk City |

Property Rental Prices in Egypt

The table below shows the average rental prices for apartments in Egypt in Q2 2023:

| Three Bedrooms | Two Bedrooms | One Bedroom | Area |

| EGP 16,000 | EGP 13,000 | EGP 11,000 | New Cairo City |

| EGP 12,500 | EGP 9,000 | EGP 8,000 | 6th of October City |

| EGP 13,000 | EGP 10,000 | EGP 6,500 | El Maadi |

| EGP 14,000 | EGP 11,000 | EGP 9,000 | Madinaty |

| EGP 12,000 | EGP 7,000 | EGP 6,500 | Nasr City |

The table below shows the average rental prices for villas in Egypt in Q2 2023:

| Five Bedrooms | Four Bedrooms | Three Bedroom | Area |

| EGP 46,000 | EGP 40,250 | EGP 35,000 | 6 October City |

| EGP 60,000 | EGP 51,750 | EGP 45,000 | El Maadi |

| EGP 60,000 | EGP 45,000 | EGP 27,000 | Madinaty |

| EGP 46,000 | EGP 40,250 | EGP 35,000 | New Cairo City |

| EGP 50,000 | EGP 43,700 | EGP 38,000 | Sheikh Zayed City |

For more information and details, you can download the full report for Market Watch from below.

You must be logged in to post a comment.